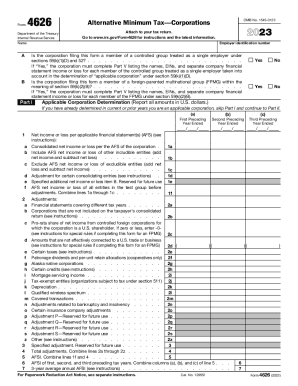

Who can use Form 4626?

Form 4626 refers not to a single individual, but to a corporation. It is the key point of the statement when taking it for certain purposes. The corporation can use it in the case of being small and exempt from the Alternative Minimum Tax. Apart from that, the Form is available to enterprises with taxable revenue along with the financial adjustments of $40,000. Moreover, the company can file it when dealing with credits for business.

What is the basic purpose of Form 4626?

AMT Detail and Summary Reports is aimed at the calculation of the Alternative Minimum Tax for an enterprise which doesn’t have any exemptions from the taxation of this very type (under the section 55). There is a strict requirement for the affiliated groups which file the consolidated report to figure the tax on a consolidated basis (under section 1501).

When is the Form 4626 due?

The statement is valid for a year as it is composed on a year-to-date basis and consists of all tax details concerning annual revenue. The form involves data about all year quarters (3). Thus, get ready to keep all financial information in good condition to have an adequate report in the end.

Are there any other forms that accompany it?

If dealing with the foreign fiscal expansion under section 59, AMT FTC (Alternative Minimum Tax foreign tax credit) has to be recalculated for every precise category of limitation pointed out on Form 1118 for corporations. Consequently, investigate this form and all its features as well.

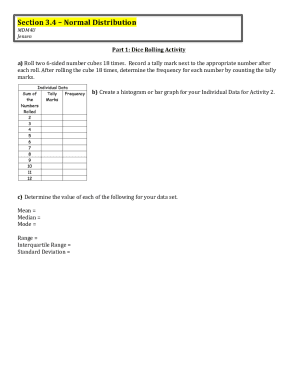

What are Form 4626’s main points to fill in?

There are multiple lines to fill in on Form 4626. They include such issues as taxable income or loss, adjustments and preferences (long-term contracts, intangible drilling costs, loss limitation, depletion, etc.), adjusted current earnings, alternative minimum taxable income, exemption phase-out, regular tax liability and others.