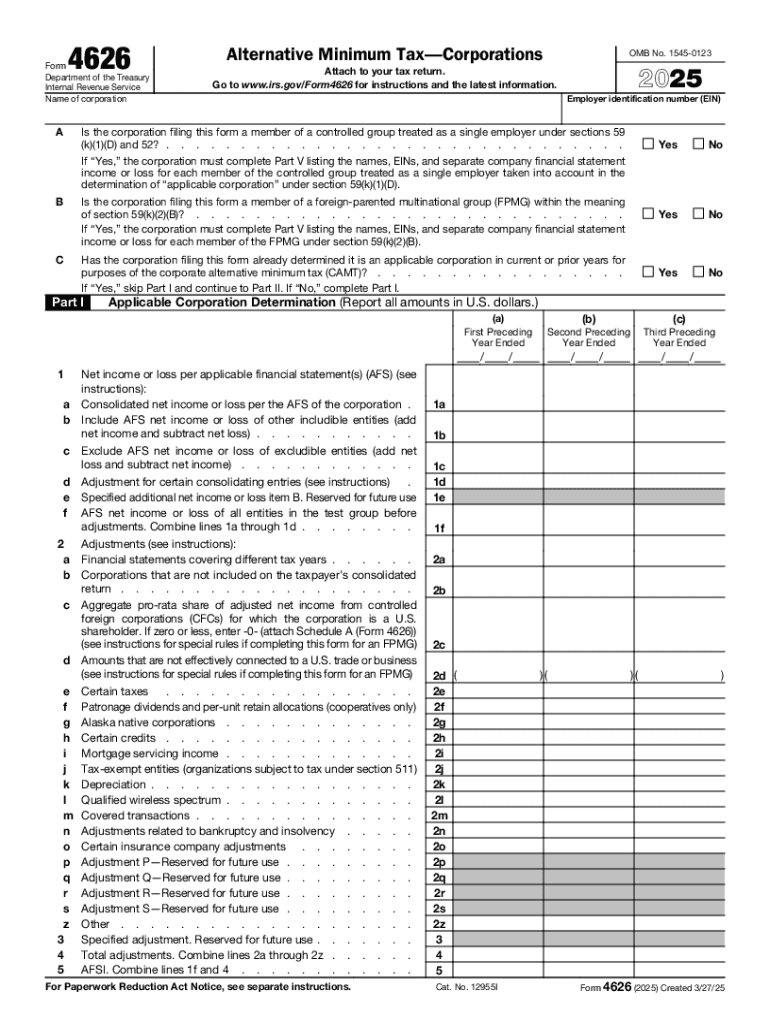

IRS 4626 2025-2026 free printable template

Instructions and Help about IRS 4626

How to edit IRS 4626

How to fill out IRS 4626

Latest updates to IRS 4626

All You Need to Know About IRS 4626

What is IRS 4626?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 4626

What should I do if I realize I made an error on my IRS 4626 after submission?

If you discover a mistake on your IRS 4626 after it has been filed, you can submit an amended form. Ensure you clearly indicate the changes made and include any necessary explanations. It is important to keep track of the filing date and ensure that corrections are made timely to avoid complications.

How can I verify if my IRS 4626 submission was received and processed?

To verify the receipt and processing of your IRS 4626, you can check your e-file status online if submitted electronically. Look for common rejection codes that may indicate issues, and ensure to keep any confirmation emails or receipts as proof of submission.

What should I be aware of regarding privacy and data security when filing the IRS 4626?

When filing the IRS 4626, it's crucial to prioritize privacy and data security. Ensure that any software used for filing is reputable and encrypts your sensitive information. Additionally, maintain secure records of your filing to protect against unauthorized access.

What are the common pitfalls to avoid when completing the IRS 4626?

Common errors when completing the IRS 4626 include miscalculating figures or neglecting to include required information. Double-check all entries for accuracy and make sure the form aligns with the latest filing instructions to avoid unnecessary delays or rejections.

If I receive a notice from the IRS regarding my IRS 4626, what steps should I take?

If you receive a notice related to your IRS 4626, read it carefully to understand the issue. Gather any requested documentation and respond by the specified deadline to maintain compliance. If necessary, consult with a tax professional for guidance on how to address the notice.

See what our users say